Capital Acquisition, Grants & Investor Readiness

We support space and deep tech companies in raising capital through Pitch Deck design, Investor Relations (IR), and Public Funding support (ESA, Horizon Europe). Raising funds for hardware and deep tech requires a specific approach that addresses technology readiness levels (TRL) and long-term ROI. We translate technical excellence into investable assets, from non-dilutive public grants to Series B equity rounds.

Capital Services:

-

Your pitch deck is your business card. We do not just make slides look good; we architect the storyline. We structure your Problem-Solution-Fit, market sizing, and technology moat into a persuasive narrative, wrapped in high-end design that signals competence and trust to Venture Capital funds.

-

European grants are highly competitive. We specialize in drafting the non-technical sections that often determine the score: Impact, Dissemination, and Management. We support your applications for the EIC Accelerator, ESA Business Incubation Centres (BIC), and Horizon Europe programs to secure non-dilutive funding without giving up equity.

-

Investors invest in traction, not just ideas. We execute targeted outreach campaigns to secure Letters of Intent (LOIs) and Pilot Agreements from industrial partners. By proving that the market is waiting for your solution, we significantly de-risk the investment opportunity for VCs.

-

Closing the round is just the beginning. We manage your ongoing communication with shareholders through professional quarterly reporting and newsletters. Consistent, transparent IR builds trust and paves the way for faster, easier follow-on financing rounds.

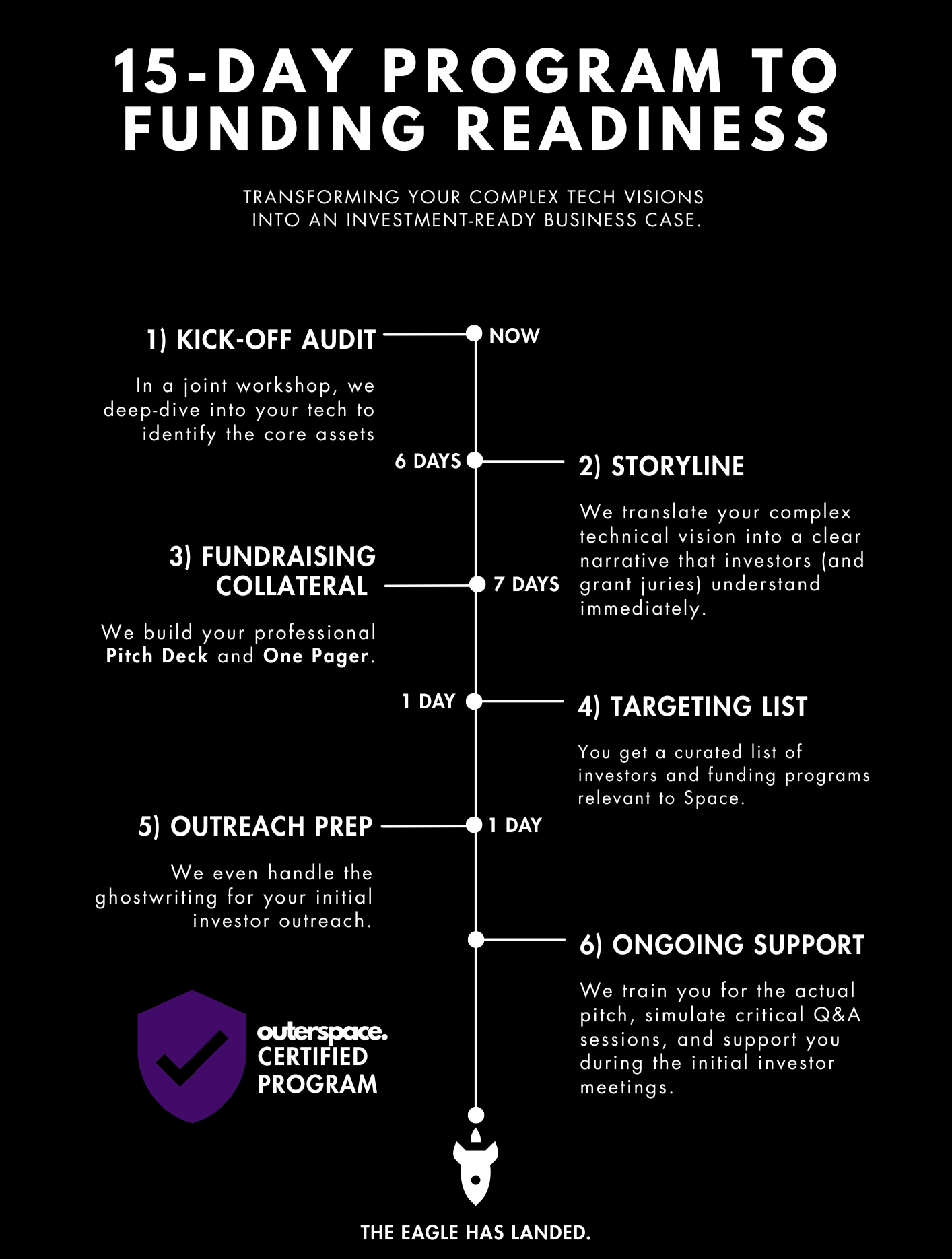

outerspace. CERTIFIED

The outerspace. certificate is a quality promise to investors and grant juries. It confirms that a startup has successfully navigated our intensive 15-day program, resulting in a sharpened narrative, a professional suite of fundraising collateral, and a customized roadmap for capital acquisition.

Startups that complete the outerspace. Certified Program are proven to be market-ready.

LinkedIn Integration: Visible Expertise

Official Verification: The certificate can be added to your LinkedIn profile under "Licenses & Certifications" with a single click.

Verified Skills: Based on our 15-day framework, we validate your competencies in Pitch Deck Design, Investor Readiness, Business Strategy, and Storytelling.

Network Advantage: Displaying the outerspace. logo on your profile signals execution power and professional preparation to the global Space and VC community.

Ready for the 15-day program?

Let's ensure your "Eagle" lands successfully.

FAQ

-

Companies can apply for ESA Business Incubation (BIC) or specific programs like ARTES. Success requires not just technical specifications, but a strong business case and impact analysis. specialized agencies like outerspace. help draft these commercial sections to meet the evaluators' criteria.

-

Dilutive funding (e.g., from VCs or Angels) requires giving up equity (ownership shares) in the company. Non-dilutive funding (e.g., Grants, Awards, Tax Credits) provides capital without giving up ownership. A healthy funding strategy often mixes both to minimize founder dilution.

-

A high-quality pitch deck usually takes 2-4 weeks to complete. This includes the strategic workshop (storylining), content drafting, and high-end design iteration. We can work faster in "Sprint Mode" if you have a hard deadline for a conference or meeting.

-

No agency can ethically guarantee funding, as the final decision lies with the investors or evaluators. However, our track record shows that professionally prepared narratives and documents significantly increase the probability of success and often lead to higher valuations.

-

We offer flexible models: Fixed-price projects for deliverables (like Decks), monthly retainers for ongoing Investor Relations, and success-fee-based models for eligible startups where we share the risk.